Starter Homes in Connecticut - Part Two

Sep 24, 2021

This is part two of our series on the current and future state of “starter homes” in Connecticut. The first part of the series can be found here.

As our understanding of how COVID-19 is shaping Connecticut’s affordable housing landscape continues to evolve, we are taking a closer look at one aspect of the market: starter homes. Once vital to achieving the American Dream of homeownership, starter homes are quickly becoming a thing of the past. We’ll explore what happened to the concept of the starter home in Connecticut, and what can be done to reinvigorate homeownership opportunities for generations looking to purchase their first homes.

Part Two: What is a "Starter Home?"

Purchasing a home has become more difficult for many in Connecticut, particularly first-time homebuyers and lower income individuals. Greater demand and a limited supply of housing have led to increased home prices. When adjusted for inflation, the median home sales price in 2020 was at an all-time, 20-year high of $267,000, up from $235,000 the year before. With a lack of new housing being built and increased demand driving prices upward, the number of affordable “starter homes” sold has declined in 2020.

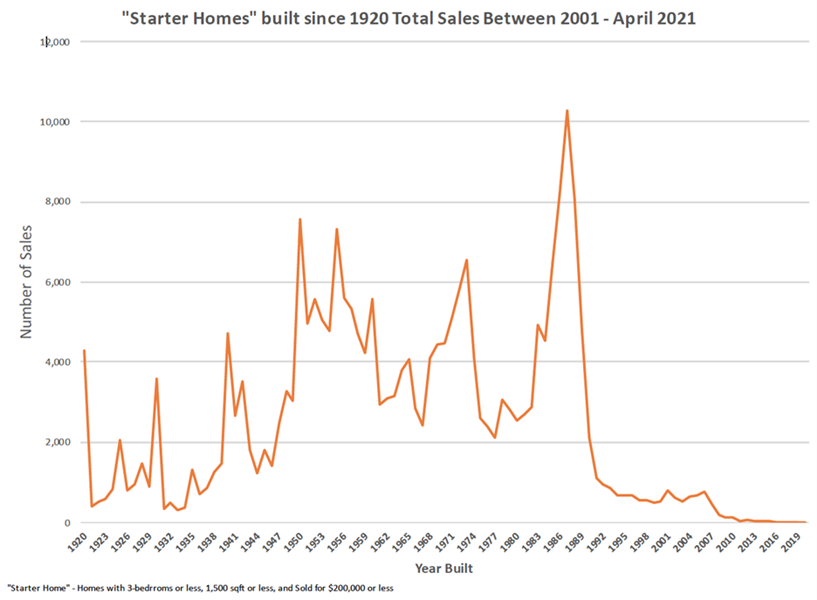

For our purposes we will define a “starter home” based on what is often viewed as a “traditional” home purchased by a first-time homebuyer, that is 1,500 square feet or less, with three or fewer bedrooms, and priced at or below $200,000. Based on 20 years of home sales data, the stock of “starter homes” most frequently purchased were built between 1950 and 1990. In fact, homes built in the mid to late 1980s tend to have the most churn in the market. This is likely due to the significant number of condominiums built during this period.

Want more housing insight? Check out our Connecticut Monthly Housing Market Dashboard.

The increased demand for single-family housing has in turn sparked a resurgence in new residential construction. According to the Harvard Joint Center for Housing Studies, nationwide single-family housing starts are on pace to top one million, a figure not achieved since 2007. While some communities in Connecticut have seen an increase in home construction permits, the effect likely will be hyper-localized. As a whole, the state has not experienced a significant increase in the number of single-family housing construction starts. The lack of new housing construction, particularly around housing priced for entry level or lower income consumers, places a premium on the existing, older housing inventory.

To make matters worse, the increased cost of construction materials and a shortage of construction labor has resulted in increased housing production and rehabilitation costs. The cost of construction labor has increased by 2.8 percent in March 2021 compared to the previous year, while lumber prices jumped a staggering 83 percent during the same period. These increased costs have resulted in a 14 percent year-over-year increase for new residential construction.

This lack of existing inventory, increased demand due to migration patterns and the large millennial generational cohort forming their own households has placed significant market pressure on first-time homebuyers and lower-income families looking to purchase a modest home. While home purchase lending products may help alleviate some of the market pressures, a supply-side production approach should be explored.

****

Jonathan is a Manager in the Research, Marketing, and Outreach department where he investigates the intersection of housing policy, planning and economics. He is a certified planner and holds a BA in International Studies and an MA in Public Policy from Trinity College. He is currently a PhD student of Geography, studying urban planning and policy at Birkbeck, University of London.