Starter Homes in Connecticut - Part One

Aug 10, 2021

As our understanding of how COVID-19 is shaping Connecticut’s affordable housing landscape continues to evolve, we are taking a closer look at one aspect of the market: starter homes. Once vital to achieving the American Dream of homeownership, starter homes are quickly becoming a thing of the past. We’ll explore what happened to the concept of the starter home in Connecticut, and what can be done to reinvigorate homeownership opportunities for generations looking to purchase their first homes.

Part One: The COVID Single-Family Housing Market

The single-family home purchase market in Connecticut has experienced some significant changes over the last year. Housing experts are unclear how much will permanently change in the housing market, but what is clear is COVID-19 has had a significant impact. Home sales without a mortgage outpaced those with a mortgage between April and June of 2020, largely due to a dip in mortgage lending and a jump in cash offers. Additionally,

Connecticut became one of the top “inbound” states to move to, while neighboring New York and Massachusetts both became top “outbound” states due to COVID-19.

Investors also add to the pressures on demand in Connecticut. Based on the last 20 years of Warren Group home sales data, the state has seen a small, but steady, increase in homes purchased by investors. In 2001, around 10.3 percent of homes sold at or below $200,000 were purchased by investor owners; by 2019 that number was closer to 25.4 percent. Investors pulled back slightly in 2020 but they still played a significant part in the home purchase market accounting for just shy of 23 percent of home purchases.

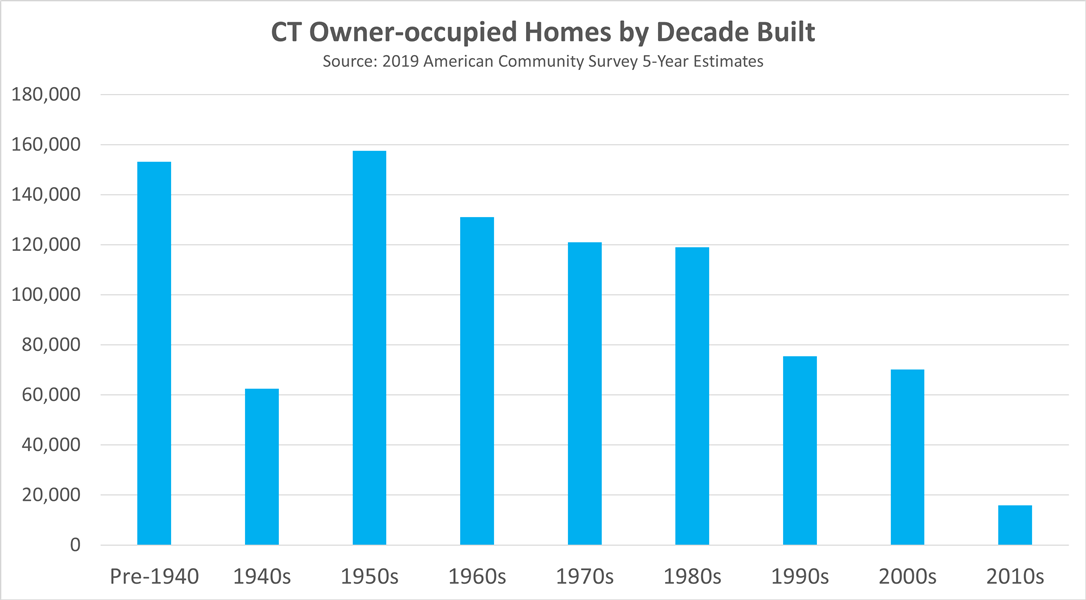

It wasn’t only demand that impacted the state’s housing market, constrained supply exacerbated the stresses on the market. Between 2010 and 2019, there was an estimated 77 percent decline in the number of owner-occupied homes built when compared to owner-occupied homes built the previous decade. This is likely due in large part to the devastating effect that the financial crisis had on homeowners, however the decline goes back several decades earlier. Housing production in Connecticut peaked in the 1950s and has been in a steady decline since the 1960s. Roughly 157,500 owner-occupied homes were built between 1950 and 1959 compared to the 15,900 or so built between 2010 and 2019.

****

Jonathan is a Manager in the Research, Marketing, and Outreach department where he investigates the intersection of housing policy, planning and economics. He is a certified planner and holds a BA in International Studies and an MA in Public Policy from Trinity College. He is currently a PhD student of Geography, studying urban planning and policy at Birkbeck, University of London.