What can we learn about housing in Connecticut from the latest Census data?

Oct 29, 2025

The latest edition of CT Housing Pulse looks at what the newly released 2024 American Community Survey reveals about Connecticut’s housing market. From shifting household sizes to rising home values, the data offer a snapshot of key trends shaping housing in our state. Check out previous Housing Pulse posts on Connecticut's homeownership and rental markets.

On September 11th, the U.S. Census released the 2024 1-Year American Community Survey (ACS) Estimates. Here are 5 key findings from this data release. (Note: the Census Bureau did not release the regular 1-year ACS in 2020 due to the COVID-19 pandemic. You can learn more about why, here.)

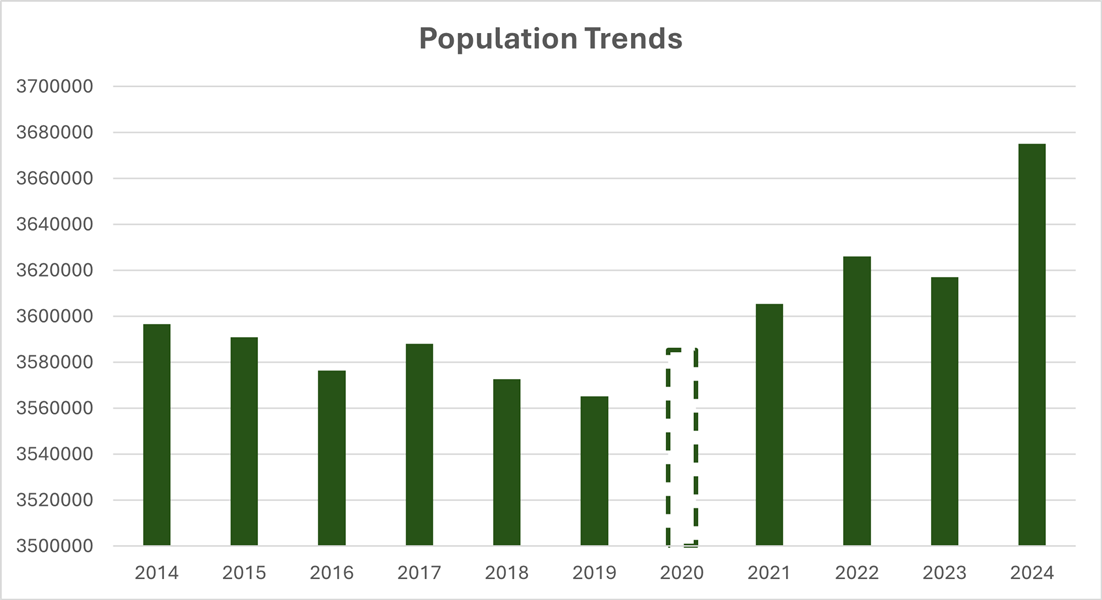

1. Population and household formation continue their upward trends.

Source: 1-Year ACS Estimates

After nearly a decade of a flat or negative population trend, Connecticut appears to have seen notable population growth in recent years. Between 2019 and 2024, the ACS reports that the state added just under 110,000 residents or a 3% increase, with 58,000 residents added between 2023 and 2024 alone. While significant, this increase can largely be attributed to a methodological change in the Census Bureau’s population estimates. You can read more about that change here.

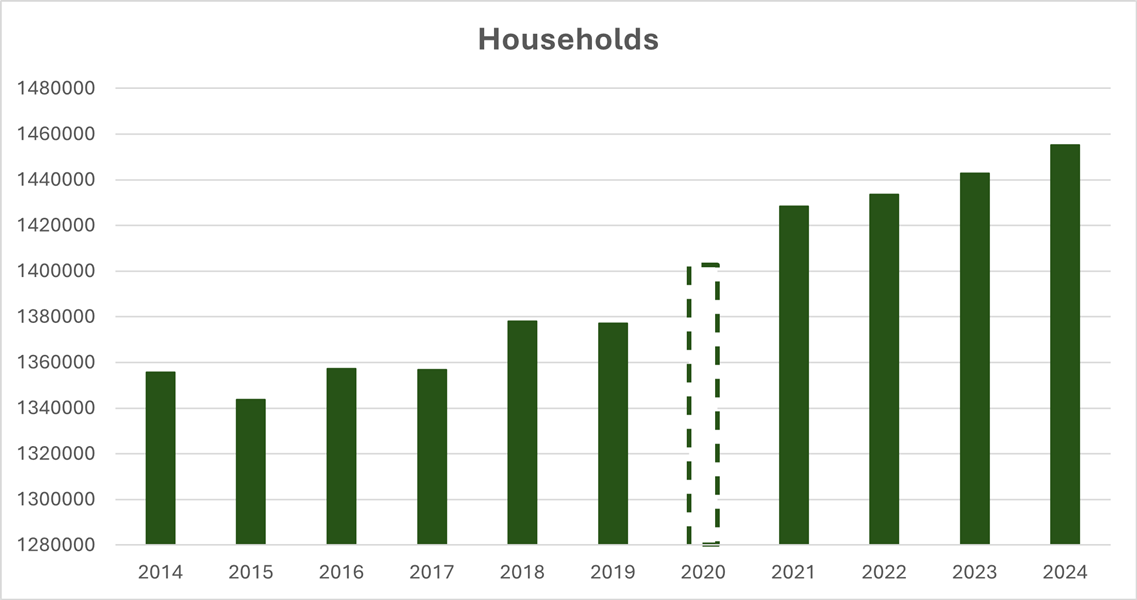

Source: 1-Year ACS Estimates

With an increased population, the state has also seen an increase in the number of households. In 2024, there were roughly 78,000 more households than there were in 2019, a 5.7% increase. Another factor driving this household formation trend is the decrease in the household sizes. Between 2014 and 2024, the average household size went from 2.57 to 2.45 people.

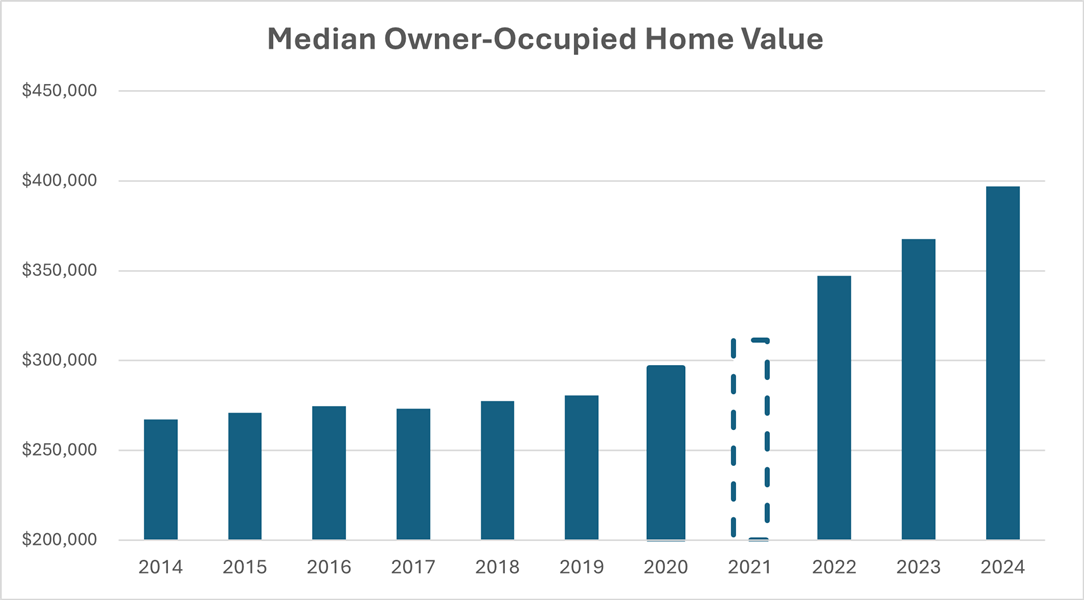

2. Home values continue their rapid rise.

Source: 1-Year ACS Estimates

The median value of owner-occupied units has rapidly increased since 2019. In 2024 the Census reported a median home value of $396,900 in Connecticut, up 41% from 2019.

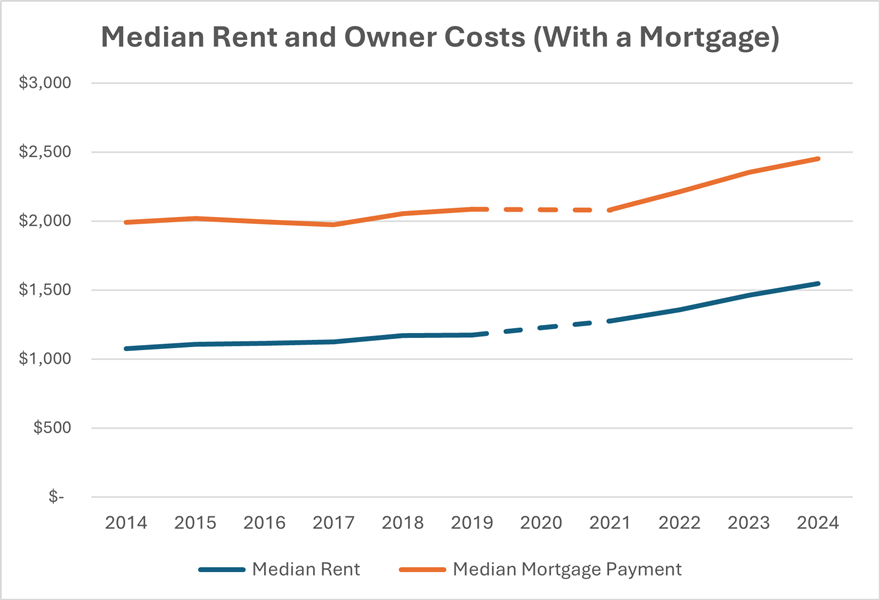

3. Rents and mortgage payments are on the rise.

Source: 1-Year ACS Estimates

Both the median monthly payment for units with a mortgage and the median gross rent have also increased significantly in Connecticut. These have increased 18% and 32% respectively since 2019.

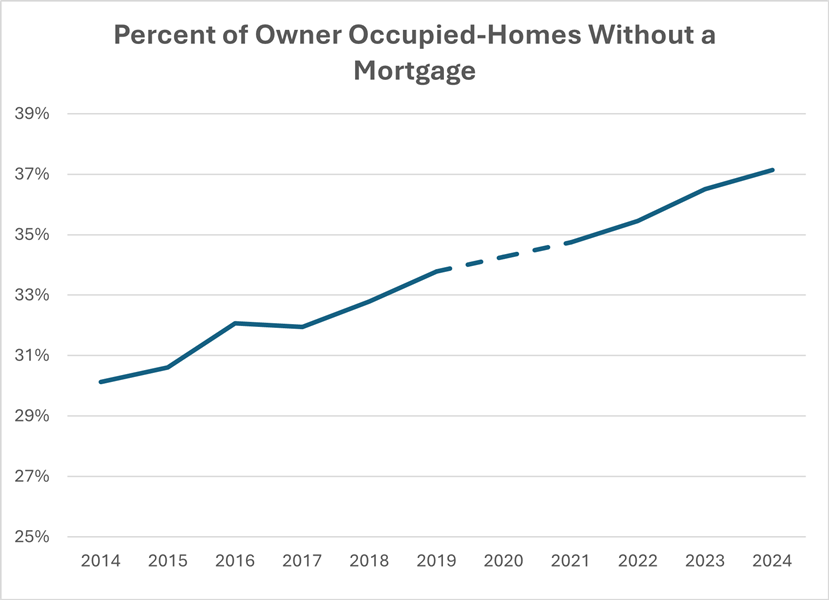

4. An increasing number of homeowners own their home free and clear.

Source: 1-Year ACS Estimates

The share of owner-occupied homes without a mortgage continues to rise—now at 37% in Connecticut. With no monthly mortgage payment to offset, many of these homeowners are less inclined to sell, especially given today’s higher interest rates. Together, these dynamics are contributing to the state’s persistent shortage of homes for sale.

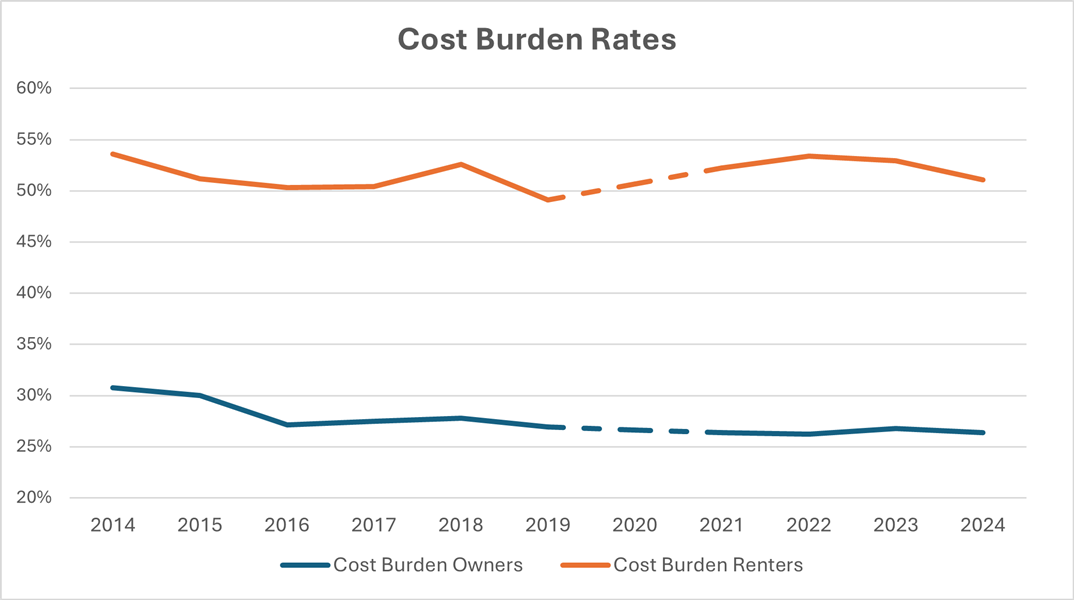

5. Homeowner cost burdens are decreasing while half of renters still see high housing costs.

Source: 1-Year ACS Estimates

Households are considered cost burdened when they spend over 30% of their gross income on housing costs. Since 2014, cost burden rates in Connecticut among renters have remained consistent, with half of renters paying over 30% on housing costs. Among homeowners, cost burden rates have been steadily declining, from 31% in 2014 to 26% in 2024.

For more insights like this, check out CHFA’s Housing Needs Assessment Dashboard.

Sign up to receive Intersect blog posts right in your Inbox!

------------------------------------------

Andrew Bolger is a Senior Research and Data Analyst in the Connecticut Housing Finance Authority’s Research, Marketing, and Outreach Department. In this role he manages CHFA’s housing database, tracks and analyzes housing market conditions, and evaluates CHFA programs. He received a BA in Economics and Political Science and an MA in Public Policy from the University of Connecticut.