CHFA’s Quarterly Housing Market Rundown: 2022 Year in Review

Feb 06, 2023

The Intersect first launched its quarterly rundown in February 2022 with the goal to bring readers a succinct but informative bulletin on the state of Connecticut’s housing market. Throughout the year, our blog has covered a range of topics from the impact of COVID-19 on inventory and vacancy rates to the rising unaffordability of single-family homes and rental units in the state. Now, as we enter into a new year, The Intersect brings you a rundown of the most important trends from 2022 and shares forecasts of what is to come for the housing industry in 2023.

Housing Supply & Rising Construction Costs

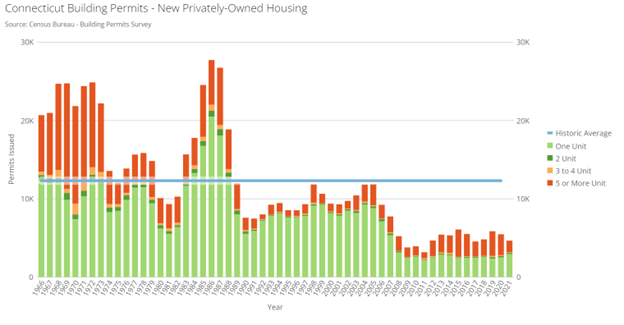

Throughout 2022, our blog highlighted the drastic reduction in single family inventory caused by effects of the COVID-19 pandemic and other global events including the war in Ukraine. Labor shortages, supply chain issues, and rapidly rising inflation increased the cost of construction for new housing by a projected 14% in 2022 according to CBRE’s U.S Construction Costs Trends Report. In the same report, CBRE discussed how the Great Recession saw an exodus of construction labor from the market, resulting in shortages of builders and the inability to meet construction demand. The impact of these forces in Connecticut is highlighted in the below chart. Here we see how economic conditions have shaped the state’s housing supply in the past decades. There is first a major drop-off as a result of the Savings and Loan crash and economic unrest at the end of the 1980’s. Recovery from this period was slow and then devastated once again at the onset of the Great Recession. During this time, Connecticut saw large reductions in single family new construction, and in particular, homes under 1,500 square feet which are priced to first time homebuyers.

The onset of COVID-19 saw a marked dip in construction as well, particularly when it came to buildings with five or more units. While full 2022 data is not yet available, permitting numbers through November indicate a small rebound in construction. Permits issued in 2022 (4,771 through November) exceeded the total number of permits issued in 2021 by over 120. Construction for multifamily properties rebounded significantly, with a 50% year-over-year increase. Conversely, upward pressures on construction costs appear to have deterred single-family new build activity. In a recent Hartford Courant article, a local builder cited that inflation, particularly in wages, has pushed the costs per square to frame a house to $10, up from $3-$5 in recent years. Data through November 2022 shows a decline in the construction of new one-unit properties by 22%. Going into 2023, construction costs and consequently the number of new single and multifamily units will be critical in addressing both housing need and affordability.

Homebuyers Faced Continued Challenges in a Competitive Market

Historical impacts coalesced with current events in 2022 to create a shortage of housing supply which has driven up prices for potential homebuyers. The median residential sale price in July 2019 was $250,000 with prices reaching a peak of $340,000 in July of 2022. Pre-pandemic, most Connecticut markets saw about 20% of homes sell above the list price. As of September 2022, all Connecticut markets remained above this marker, with between 40-60% of listed homes selling above asking price (see Chart XX). This rate exceeds the United States average of about 30%, indicating Connecticut markets are cooling at a slower rate than the nation as a whole, as demonstrated in the below chart which utilizes Zillow home sales data from the past five years.

Buyers also faced shorter turnaround times on listed homes. In many Connecticut markets, properties were listed for less than 30 days before a purchase and sales agreement was signed. In some markets, this number was under ten. Compared to 2018, properties across the state were selling more than twice as fast in 2022 based on home sales data from Zillow. Each of these factors – increased demand, fewer days on market, and a lack of housing stock to begin with – contributed to upward pressure on home prices this year and will certainly influence any potential release of pressure in 2023.

Interest Rates Prevailed Through Home Buying Season

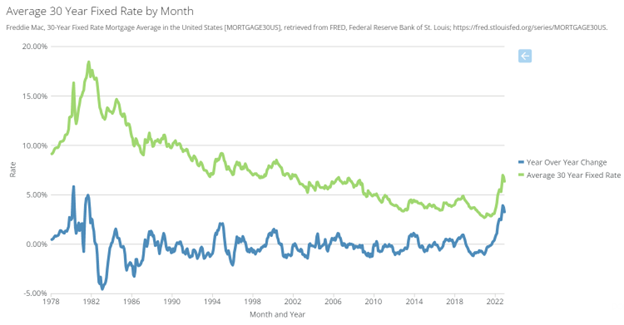

The start of 2022 continued trends from the previous year, with low interest rates benefitting homebuyers primarily through the first quarter. However, as the year progressed, interest rates began to climb as a result of the Federal Reserve’s attempts to slow down inflation. Interest rates grew from 3.45% at the start of the year and peaked just below 7% in October. This reflected a year-over-year interest rate increase of almost 4%, the highest growth in interest rates since the 1980s.

Higher rates increased the burden of access to homeownership for many Connecticut residents. In a blog post from Harvard’s Joint Center for Housing Studies, researchers shared a map assessing the required income to afford a median priced home in each state. For much of Connecticut, the median sales price in 2022 was around $350,000. The Center estimates that to comfortably afford a purchase of this price, a household would need to be making between $80,000 to $100,000 a year. Based on the most recent American Community Survey data for the state, almost half of Connecticut’s households make less than this amount.

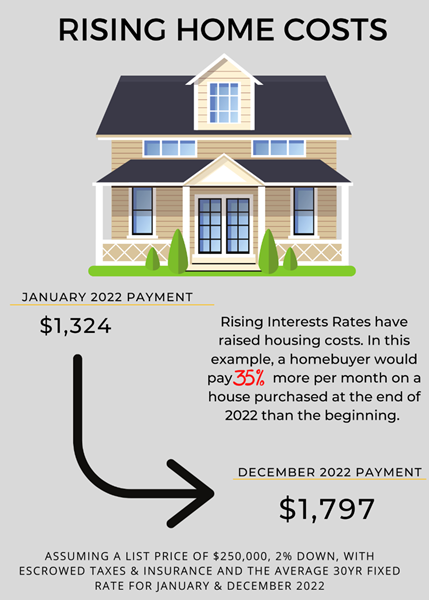

With prices remaining high and interest rates growing, monthly mortgage payment amounts have soared when compared to the start of the year. As demonstrated below, a home purchased in December 2022 might cost 35% more than the same property purchased in January based on rising interest rates alone. This increase is untenable for many prospective buyers who may now be forced for remain in rental situations until interest rates begin to decrease.

The second quarter saw an uptick in inventory, although overall rates continue to be historically low across all Connecticut metros. This uptick is consistent with the traditional spring and summer home buying season which is cyclical in nature. However, as shown in the chart below, inventory has been on a stark decline since the end of the 2019 buying season.

Tight Multifamily Market Impacts Renters

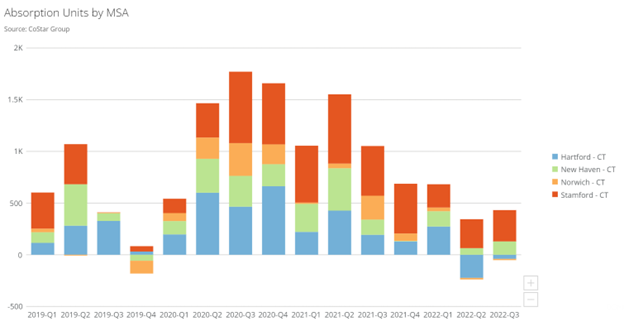

In 2021 an influx in income for renters due to direct payments from the Federal Government resulted in 600,000 units absorbed nationally as more renters formed their own households. This absorption resulted in gains for investors and some of the lowest vacancy rates seen in recent years. This demand went down in 2022 as direct payments ceased and demand slowed. By August of 2022 multifamily absorption had dropped to just over 200,000 units nationally. Absorption of units in Connecticut also saw a decline from the previous year but now look much closer to the pre-pandemic levels seen in 2019.

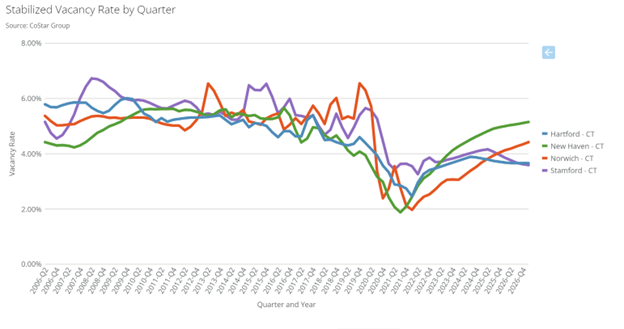

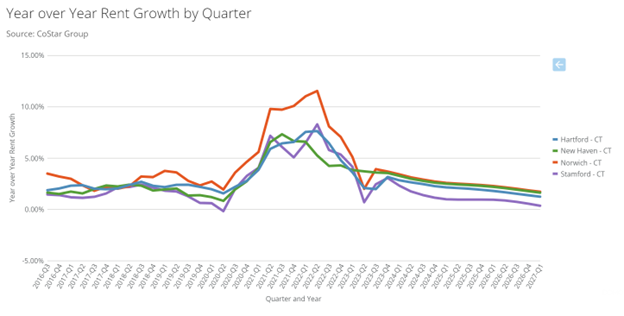

Whether lifestyle renters or renters by necessity, Connecticut renters faced tough conditions in 2022. Vacancy rates remained historically low throughout the year, indicating an over-subscribed market. As demand for limited rental stock grew, so did the listing power of the state’s landlords. Year-over-year rent growth peaked during the second quarter of 2022, growing almost 12% in the Norwich-MSA and between 5-8% in the rest of the state. Growth did begin to taper off in the latter half of the year, mimicking the decline in absorption rates seen in the above chart during the second and third quarters of the year. The below chart, which graphs vacancy rates by the different Connecticut MSA’s, offers a forecast from Co-Star group which predicts stabilizing vacancy rates over the next several years that remain lower than pre-pandemic levels.

Co-Star Group also predicts a continual drop and leveling off of rent growth over the next several years as well. Combined with increased costs, particularly for utilities and gasoline, rising rents have substantially reduced the savings power of renters. In a recent webinar, Moody’s reported that year-over-year credit card usage for non-mortgage holders has grown by 30%.

What does 2023 have in store?

Housing supply and inflation rates will continue to serve as primary drivers in the state’s housing market in 2023. Demand for housing in the past three years has far exceeded the construction of new units, both for homeownership and rental. To see a decline in this deficit, Connecticut would need to see an increase in new construction and more sellers entering the market to bolster inventory and ease competition. However, building new homes is not as simple as it once was. In 2022, producers and consumers saw inflation rise as a result of supply chain issues, rising energy costs, and rapid increases in wages. The price of construction materials climbed for most of 2022. Some builders fear that if inflation does not ease in 2023, prospective homebuyers looking to build their dream home may pull back. The Intersect will be keeping a close eye on building permit numbers throughout the year to see how 2023 stacks up.

While many of the country’s fastest growing housing markets have begun to cool rapidly, Connecticut saw a slower downturn in 2022. If interest rates remain high through 2023, the state may see slower activity when the spring home buying season rolls around in April. Experts predict that if inflation remains high, consumers are likely to put off big purchases, like buying a home. If this becomes a reality, there is the possibility that home prices will begin to decline as properties spend more time on the market. Dropping prices will be critical to increasing access to homeownership for low- and moderate-income buyers, particularly if mortgage rates aren’t as quick to decline. In a recent article from Forbes, housing and real estate professionals all predict varying levels of cooling in the market, but express some levels of optimism when it comes to increased affordability.

In their year-end report, professional forecasters from the Federal Reserve Bank of Philadelphia did not anticipate that current actions to fight inflation would see immediate results. Forecasters predict that current-quarter headline CPI inflation will remain high at over 5% at an annual rate. As such, it’s likely we’ll see additional efforts by the Federal Reserve to fight continued high costs. Changes in the Federal ReserveFund’s rate directly impact mortgage rates and other lending costs, so decisions by the Fed in 2023 will be a strong driver for Connecticut’s housing market as a whole. In December 2022, Freddie Mac issued a multifamily outlook which predicts continued contractions in the market in 2023 with “rent growth moderating, vacancies ticking up and loan originations slowing for the year.” Increasing vacancies could mean positive things for renters as rents typically fall across markets as inventory becomes available. However, some experts worry that if inflation remains too high, construction costs could prevent additional units from becoming available, pushing down vacancy rates. While it may be too soon to tell exactly which way the markets might turn, experts appear to agree that the multifamily sector may contract in activity but will remain profitable for investors.

Getting inflation under control will be a crucial factor to increasing both the supply of housing and the ability of Connecticut residents to comfortably afford housing related expenses from their monthly mortgage payment to their utility bills.

Stay tuned in 2023 as The Intersect continues to bring you details on the housing trends to watch. Interested in a personalized presentation on the housing market to your team? Have questions or insights you’d like to share? Send a message to research@chfa.org to get in touch.Get the next report sent right to your inbox! Visit www.chfa.org/signup and select the "The Intersect - CHFA's Housing Research Blog."

****

Kayla Giordano is a Senior Program & Data Analyst in the Research Marketing and Outreach department. She holds degrees in Political Science and Economics from Eastern Connecticut State University as well as a MA in Community Development Policy & Practice from the University of New Hampshire.