A Finally Cooling Rental Market

Jun 04, 2025

Welcome back to CT Housing Pulse, CHFA’s blog series offering timely snapshots of Connecticut’s housing market. In this edition, we turn our attention to the state’s rental market—where after years of sharp increases, signs of cooling are beginning to emerge. Check out the first Housing Pulse post on Connecticut's homeownership market here.

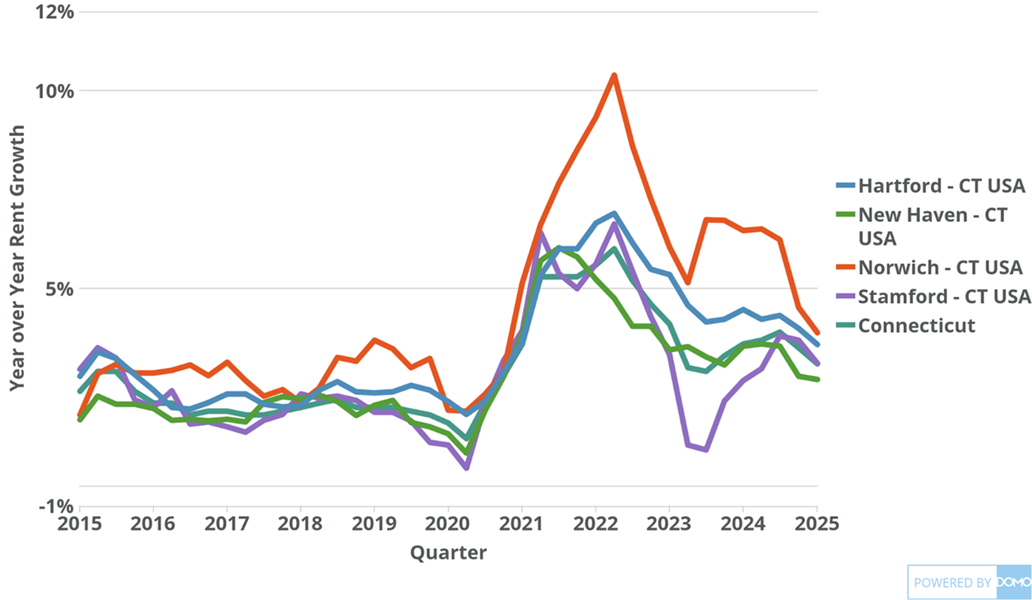

In recent years, rents across Connecticut have accelerated. In mid-2022, Connecticut’s rent growth rate peaked at 6% year over year. In certain Connecticut markets, rent growth was exceptionally high during this time. For example, the Norwich Metropolitan Statistical Area saw rent growth of over 10% year over year. This data line has come down in recent months with 3.1% statewide rent growth in Q1 2025.

Year over Year Rent Growth

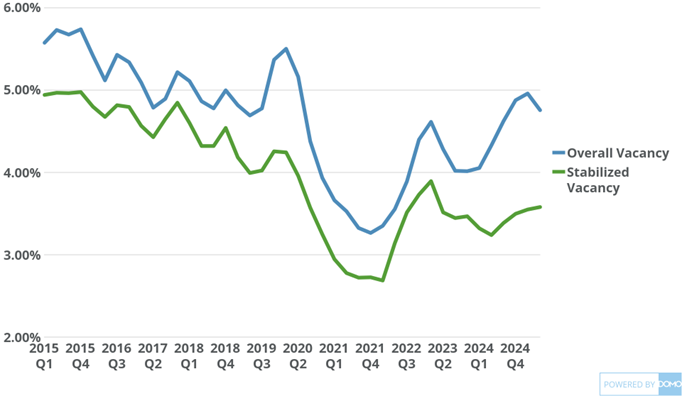

The recent cooling in rent growth appears to be driven by Connecticut’s overall rental vacancy rate returning to pre-pandemic levels. In Q1 2025 according to CoStar, the state’s overall vacancy rate was 4.95%, slightly above the Q1 2019 level of 4.81%. At the same time, Connecticut stabilized vacancy rate remains below pre-pandemic levels at 3.54% compared to 4.18%. Costar defines the stabilized vacancy rate as the vacancy rate for multi-family communities that have reached 90% occupancy following delivery or are older than 18 months from initial delivery of property.

Overall and Stabilized Vacancy Rates

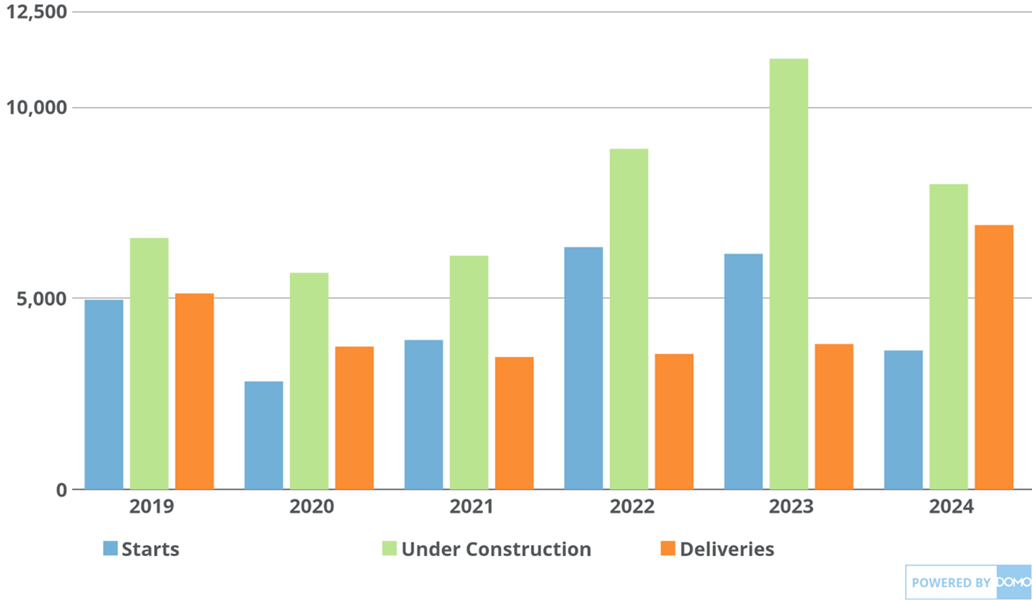

So what explains this difference in vacancy rates, and why is it important to track both? Connecticut recently underwent a rental construction wave. In 2022 and 2023, the state saw over 12,000 unit construction starts, and in 2023 there we just over 11,000 units actively under construction. This uptick in construction led to a significant increase in units delivered to the market in 2024, with nearly 7,000 new units placed in service. As the newly delivered units continue to lease up, it’s possible we could see a rise in the stabilized vacancy rate and a continued cooling of rent growth.

Connecticut Construction Starts, Under Construction, and Deliveries

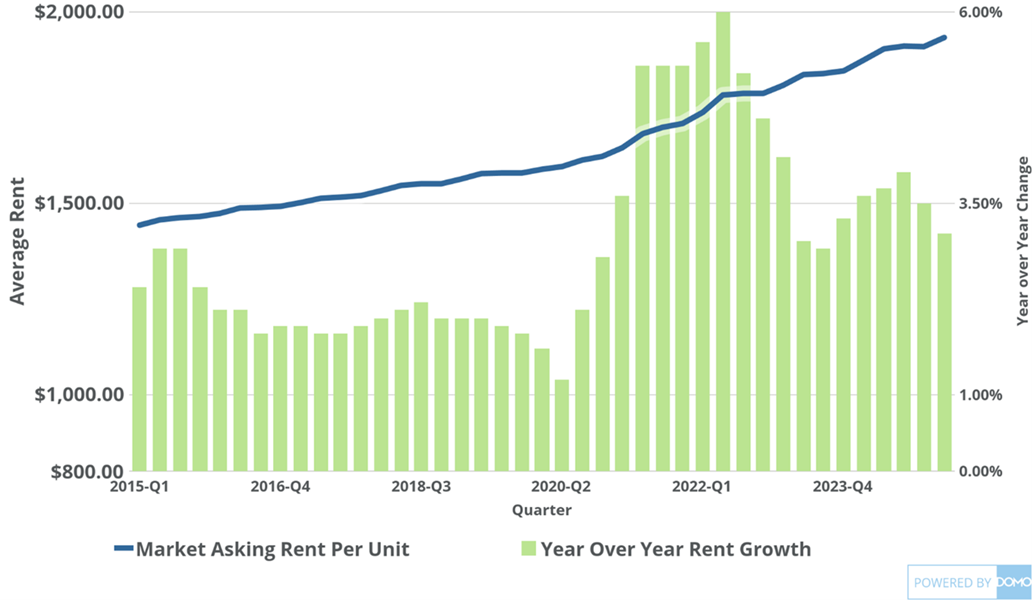

While these new units continue to lease up, average asking rents in Connecticut do remain well above pandemic levels. In Q1 2025, the average asking rent in Connecticut was just over $1,900 compared to $1,560 in 2019, a 24% increase.

These elevated rent levels indicate a clear need for programs like the Low Income Housing Tax Credit, Build For CT, and others, which are critical to getting more affordable units on the market.

Connecticut Average Asking Rent and YoY Growth

For a deeper understanding of Connecticut’s housing market, check out CHFA’s Housing Needs Assessment.

Sign up to receive Intersect blog posts right in your Inbox!

------------------------------------------

Andrew Bolger is a Senior Research and Data Analyst in the Connecticut Housing Finance Authority’s Research, Marketing, and Outreach Department. In this role he manages CHFA’s housing database, tracks and analyzes housing market conditions, and evaluates CHFA programs. He received a BA in Economics and Political Science and an MA in Public Policy from the University of Connecticut.